How Is Business Rateable Value Calculated

You may also like to try our Capital Gains Tax Calculator. The rateable value is a propertys estimated value on the open market.

Https Cdn Ymaws Com Www Ukhospitality Org Uk Resource Resmgr 2019 Appg Appg Report Business Rates F Pdf

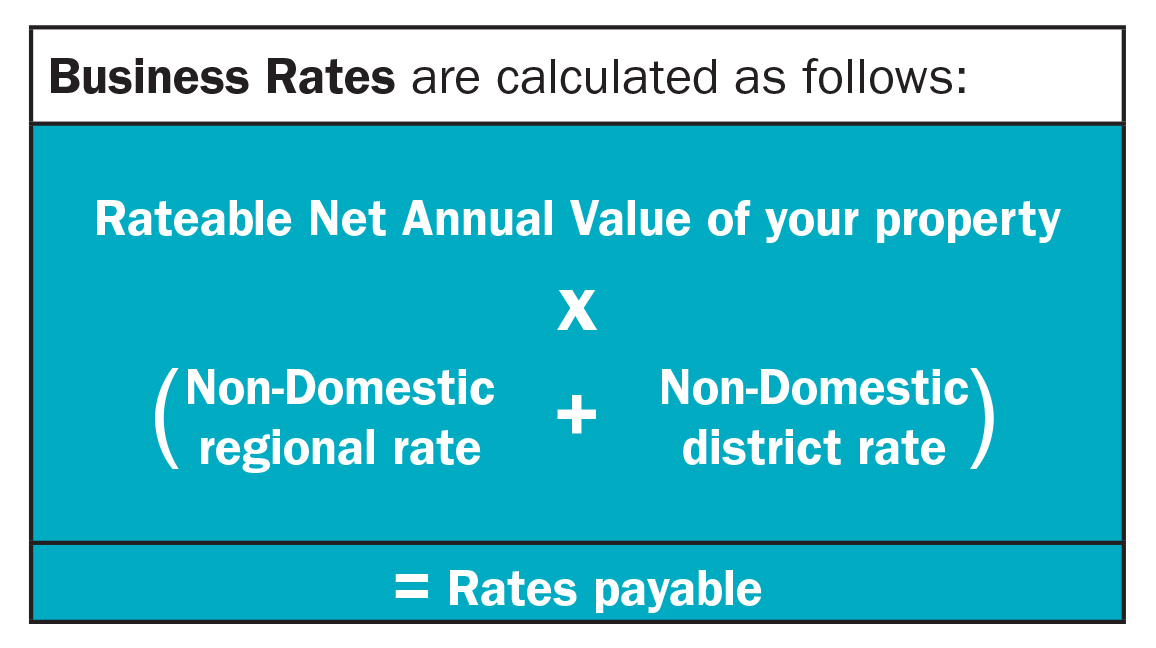

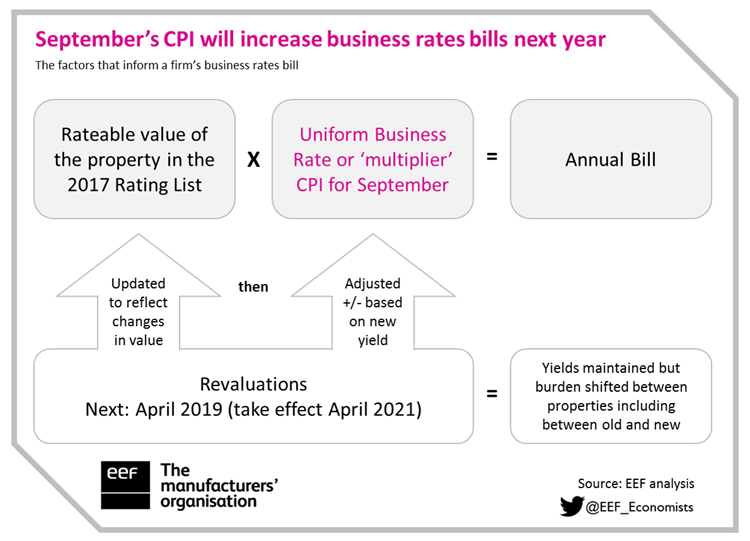

In England a propertys business rates are calculated by multiplying the rateable value by the multiplier.

How is business rateable value calculated. English Business Rates Calculator. Use the small business multiplier if your rateable value is below 51000. Rateable value is the value assigned to non-domestic premises by the Valuation Office Agency.

Assessors will usually ask property owners tenants or occupiers for this information. The rateable value of your property is then multiplied by the uniform business rate as given by the government. This is its open market rental value on 1 April 2015 based on an estimate by the.

Your rates will be calculated using a Small Business multiplier if you are someone who Is considered a small business but are not eligible for a Small Business Rate Relief. This calculation provides an indication of your rates bill for properties in England. Business rates are calculated in a two-step process.

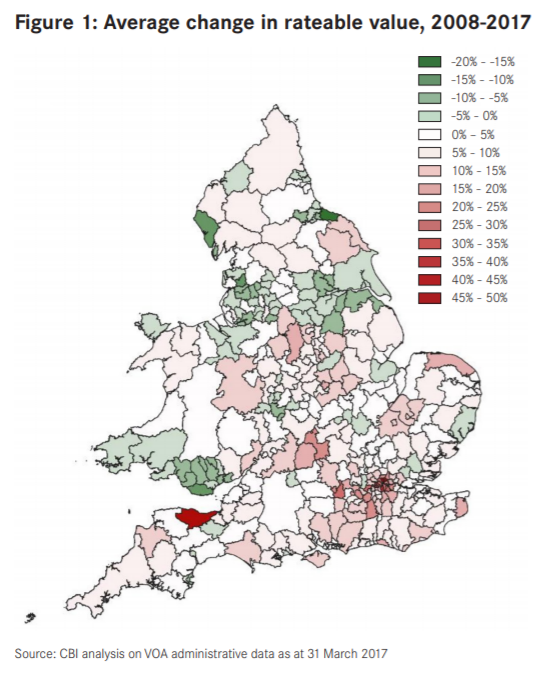

The Valuation Office Agency VOA reviews these values every five years and often values properties at different levels. Its based on a propertys annual market rent size and usage. The local council uses the rateable value and the business rates.

There are two multipliers. From 2022 revaluations will be carried out every three years. Click here to find the rateable value for your business premises.

We calculate your business rates bill for the financial year by multiplying the rateable value of the property by the appropriate multiplier and then taking off any reliefs. Find further information on eligibility for each of our business grant schemes and how to apply. For example they might use information such as rent or floor space.

It is a broad guide to your likely rates liability. Poundage is a figure set by the government which is also known as the Uniform Business Rate UBR. This applies even if you own multiple properties.

The last revaluation conducted by the Valuation Office Agency VOA and which came into effect on 1 April 2017 refers to values as of 1 April 2015. In the year 2019-2020 this was 491p 0491. The small business multiplier is 0491 and the standard multiplier is 0504.

Firstly the Valuation Office Agency VOA are tasked with estimating the annual rent the property is likely to let for as at a statutorily fixed valuation datenbsp. There has been a statutory requirement on the VOAAssessor to carry out a General Revaluation every five years. The amount of rates payable is calculated by multiplying the Rateable Value by the poundage rate.

Find the correct multiplier for the size of your business and location here. The Valuation Office Agency sets the rateable value of business premises by using property details such as rental information. How to calculate business rates.

Each area in Scotland has its own assessor. Rateable values are calculated by assessors. The standard non-domestic rating multiplier and the small business non-domestic rating multiplier.

Search for your propertys rateable value by postcode using this search option. For example Joeys business has a rateable value of 15000 and therefore should be multiplied by the small business multiplier. This is to make sure rateable value calculations are.

It does not take account of any rates relief your property may be entitled to. Revaluation usually happens every five years. This shows you how much you will.

For more information on the Rateable Value RV of your property visit The Valuation Office Agency website wwwvoagovuk. Now multiply your rateable value by the correct multiplier. If your rateable value is less than 51000 you qualify for the small business multiplier rather than the standard multiplier.

This is called a Rateable Value RV and is placed in the rating list alongside the address of the property to form the assessment. Business rates are worked out based on your propertys rateable value. If your rate liability.

Assessors use different methods to calculate rateable values. What is the Rateable Value. Business rates are calculated by multiplying the rateable value of business premises by a multiplier also known as poundage.

The local authority works out the business rates bill by multiplying. Multiply your rateable value by your multiplier. How your rates are calculated.

This process is known as a valuation. The charges for Business Rates are calculated by multiplying the rateable value of an individual. Business rates are calculated using a propertys rateable value.

How To Find Rateable Value Of Business Property Property Walls

Draft Reply For Penny To Wag Petition Letter Of

Vbvbnvb Financial Markets Take Risks Learning

How To Calculate Business Rates Uk Rating Walls

Business Rates What Is Rateable Value

How Are Business Rates Calculated Rates Wiki Altus Group Property Services

Business Rates Changes For Tax Year 2018 19 Make Uk

Business Rates Explained Place City Council

How To Calculate Business Rates Business Tips Youtube

How To Find Rateable Value Of Business Property Property Walls

Keller Williams Real Estate Companies Speed Up

Business Rates Explained Place City Council

What Do The New Business Rates Mean For Your Sme Hiscox Business Blog

Top 6 Business Rates Tips For New Office Occupiers

Business Rates Reform And How It Affects Us Woodfarm Barns

What Is The Rateable Value Of A Commercial Property Martin Slowe

The Economic Growth Incentive Issues And Adjustments Centre For Cities

Posting Komentar untuk "How Is Business Rateable Value Calculated"