What Makes You Outside Ir35

In this article we pull together a back-to-basics view on how IR35 is applied when working outside of the UK which incidentally is one of the major aspects of IR35 that will change as a part of the now-2021 reform to the off-payroll legislation. Supply your clients with a VMS thats free for them to use.

.jpg)

Latest Updates On The Ir35 Changes Change Recruitment Change Recruitment

What the worker has to do where the worker has to do it when it has to be done and how - although how is far more important than the other elements.

What makes you outside ir35. The elements of control are. If you are being engaged directly with your end client this model contract may be of assistance. If the contractors work with the company ceased before this time then it fell outside the new IR35 requirements.

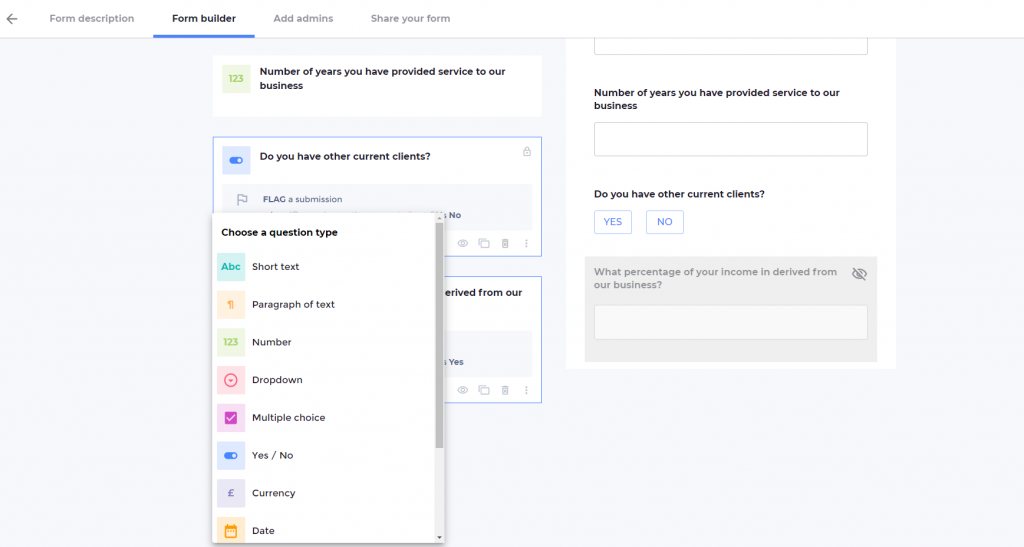

If the client end user makes the status determination that an assignment is outside IR35 they must ensure that reasonable care was taken during the decision-making process and that the decision itself is reasonable. The new IR35 rule explained. Each assessment takes 15 minutes and gives an instant result including the necessary Status Determination Statement and full reasons for the determination.

For firms that wish to engage contractors outside IR35 and mitigating any IR35 risk they can use IR35 Shield for Business which can assess all contractors in a single day. When outside IR35 Different assumptions and accounting methods are used by the various IR35 calculators available online and some are just incorrect so talk to your own accountant to work out the impact on your take-home pay based on your own. The corollary being that if the client lacks control especially in the contract this is very persuasive evidence of outside IR35 status.

A Status Determination Statement SDS is a comprehensive statement from the client which. And when HMRC investigate contractors for IR35 they usually lose the case. The legislation was designed to stop contractors working as disguised employees by taxing them at a rate similar to employment.

Takes a salary of 12500 pa. Here are the top five mistakes businesses need to avoid in order to stay on the right side of HMRC. Get help on the off-payroll working rules IR35 with webinars guidance and resources from HMRC.

So if youre working on a range of assignments some inside IR35 and some outside IR35 you need to make sure you have the right processes in place. HMRC may review the assessment however so it is important that the SDS sets out in sufficient detail the basis on which the decision is made showing that reasonable care has been taken. When it comes to how working overseas affects your IR35 status determination the caveats appear too numerous to count.

The Check Employment Status for Tax tool gives you HMRCs view of a workers employment status based on the information you provide. If the payment was for work done before 6 April 2021 and the contractor continues to work for the company then the new IR35 requirements apply to payment made after this date for work done before this date and all future. And one has to say that they not independent in this respect.

Its important to remember that IR35 status is based on each individual assignment not on the Personal Service Company PSC. Makes 3000 contributions to an allowable pension scheme. There are pitfalls for the unwary and mistakes could lead to big.

As a Limited Company Contractor or Sole Trader IR35 is an important consideration for you as it sets out the law relating to tax treatment of your income and also determines your tax position with HMRC. Verbal contracts are valid contracts for services however they make proving your IR35 status more difficult in the event of an IR35 enquiry as they dont offer written evidence therefore are. Contractor take home pay outside IR35 is significantly higher than contractor take home pay inside IR35 as contractors outside of the legislation can benefit from reduced NIC by taking the bulk of their income in dividends as it stands you can earn up to 2000 in dividends before you pay any income tax on your dividends.

WHAT YOU GET WITH VMS. If you work on assignments inside IR35 and outside IR35 and you have different revenue streams into your company then its worthwhile keeping your company trading. Declares a contractors deemed employment status following an IR35 assessment.

Its only based on HMRCs opinion as to what makes a contractor fall inside or outside of IR35. You should step back and think about your companys potential for growth and expansion over the medium term before making a decision on continuing to trade or not. Amendments to the IR35 legislation introduced within the Finance Bill 2020 require that clients provide an IR35 status determination statement when assessing the IR35 status of contractors before a contract begins.

Test Based on HMRCs Opinion. Contractors that fall outside IR35 legislation are. This new IR35 Employment Status test has no basis in law.

A contractor is unlikely to challenge an SDS which assesses them as falling outside the scope of IR35. For more information keep up to date with our IR35. You may be offered schemes that wrongly claim to get around the off-payroll working rules.

Understand your costs in a way that makes sense to you whether thats per-project per-site or per-division or in some other way. Assignments Outside IR35. There seems to be much confusion on the application of the IR35Off-payroll working administrative rules scheduled to apply from April 2020 where there are overseas aspects for example where the worker provided by a personal service company or similar entity PSC is based overseas or where the worker and PSC are in the UK but the end client is based elsewhere and its easy to see.

Get a single integrated and easy-to-use platform that cuts mistakes duplication and time spent on admin. IR35 affects all contractors who do not meet HMRCs definition of self-employment.

5 Things Clients And Contractors Need To Know About Ir35 Red Sap Solutions

Ir35 Changes 2021 How Does It Impact Uk Life Science Businesses Proclinical Blogs

Changes To Ir35 Legislation Pharmatimes

What Is Ir35 And Why Is It Dangerous Ground For Independent Contractors

5 Things Clients And Contractors Need To Know About Ir35 Red Sap Solutions

Four Things Organisations Need To Consider For Ir35 Cxc Global

An Outside Ir35 Contract Evolution Jobs Uk

What Is Ir35 What You Need To Know Vinciworks Blog

What Is Ir35 Inside Outside Ir35 The Ultimate Guide

How Much Will Ir35 Cost You Outside Inside Perm Foxy Monkey

Dividend Tax Calculator 2020 21 Tax Year It Contracting Dividend Financial Decisions Dividend Income

Expert Faq Are You Inside Or Outside Ir35 It Contracting

A Simple Guide To Ir35 And How It Effects You 24 Seven Talent

What Do Ir35 Changes Mean For Recruitment Agencies

What Is Ir35 How Can Companies Avoid Ir35 Apzo Media

What Lessons Can We Learn From Ir35 In The Public Sector Twenty Recruitment

What Do Ir35 Changes Mean For Recruitment Agencies

How To Prepare For Ir35 Williams Kent

New Contract Role Azure Devops Engineer 3 Months In Manchester Message By Inbox If You Are Interested Or Comment Central Manchester Engineering Manchester

Posting Komentar untuk "What Makes You Outside Ir35"